How much will mortgage lenders lend me

Email and calendar plus so much more. Those associated with your buy-to-let mortgage before reaching a decision as to how much they would be prepared to lend you for an additional mortgage.

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Ap Getting Into Real Estate Real Estate Tips Buying First Home

To determine how much you can qualify for.

. While they look at your income from any work additional income such as that from investments is included in their assessment. Its actually a contract between you the borrower and a lender like a bank mortgage company or credit union to lend you money to buy a home. It was characterized by a rise in subprime mortgage delinquencies and foreclosures and the resulting decline of securities backed by said mortgages.

ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. Not its current value. The AAG Advantage Jumbo Reverse Mortgage is AAGs privately offered reverse mortgage intended exclusively for owners of high-value homes.

The basic steps are. If you bought a 600000 house with a 5 deposit of 30000 then your LMI premium could cost over 22000 based on Finders LMI estimator. The difference is that under the new rules the familys affordability has dropped by 101868 -15.

Whether youre looking to take a 5000 loan or even 15000 our loans calculator can help you work out how much you can afford to borrow by entering how much you can afford to pay back each month and the length of time you can afford to pay that. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today.

You should speak to a mortgage broker before you apply to ensure youre matched with a lender whose criteria you fit. What Private Money Mortgage Lenders Want. Loan approval will be subject to but not necessarily limited.

Subprime mortgage crisis was a set of events and conditions that led to a financial crisis and subsequent recession that began in 2007. Find out what you can borrow. Heres how much your monthly mortgage payment will cost.

Private money lenders dont want hassles they dont want to foreclose they dont want to own the property and they dont want difficulties in earning their returns. Several major financial institutions collapsed in September 2008 with significant. An example using Ratehubs Mortgage Affordability calculator.

You must meet standard bank policy without your partners income. All reviewed mortgage lenders that offer VA loans were evaluated based on 1 the portion of their business dedicated to VA lending 2 their VA origination fees 3 the range of VA loans. We would then lend you the 450000 needed to buy your new home.

Mortgage lenders generally offer between 3 to 45 times your annual income. Or 4 times your joint income if youre applying for a mortgage. What will my loan cost.

Angel Oak Home Loans is a full-service mortgage lender offering traditional and portfolio mortgage loans. Most mortgage lenders will class your debt-to-income ratio as high. Interest rates are expressed as an annual percentage.

You may have to pay Lenders Mortgage Insurance LMI if you borrow more than 80 of the property value. If youve only saved 50000 but you have sufficient income to support the loan you may be able to take advantage of Lenders Mortgage Insurance. If youd like our help to find the lowest LMI premium then please call us on 1300 889 743 or fill in the details on our online assessment form.

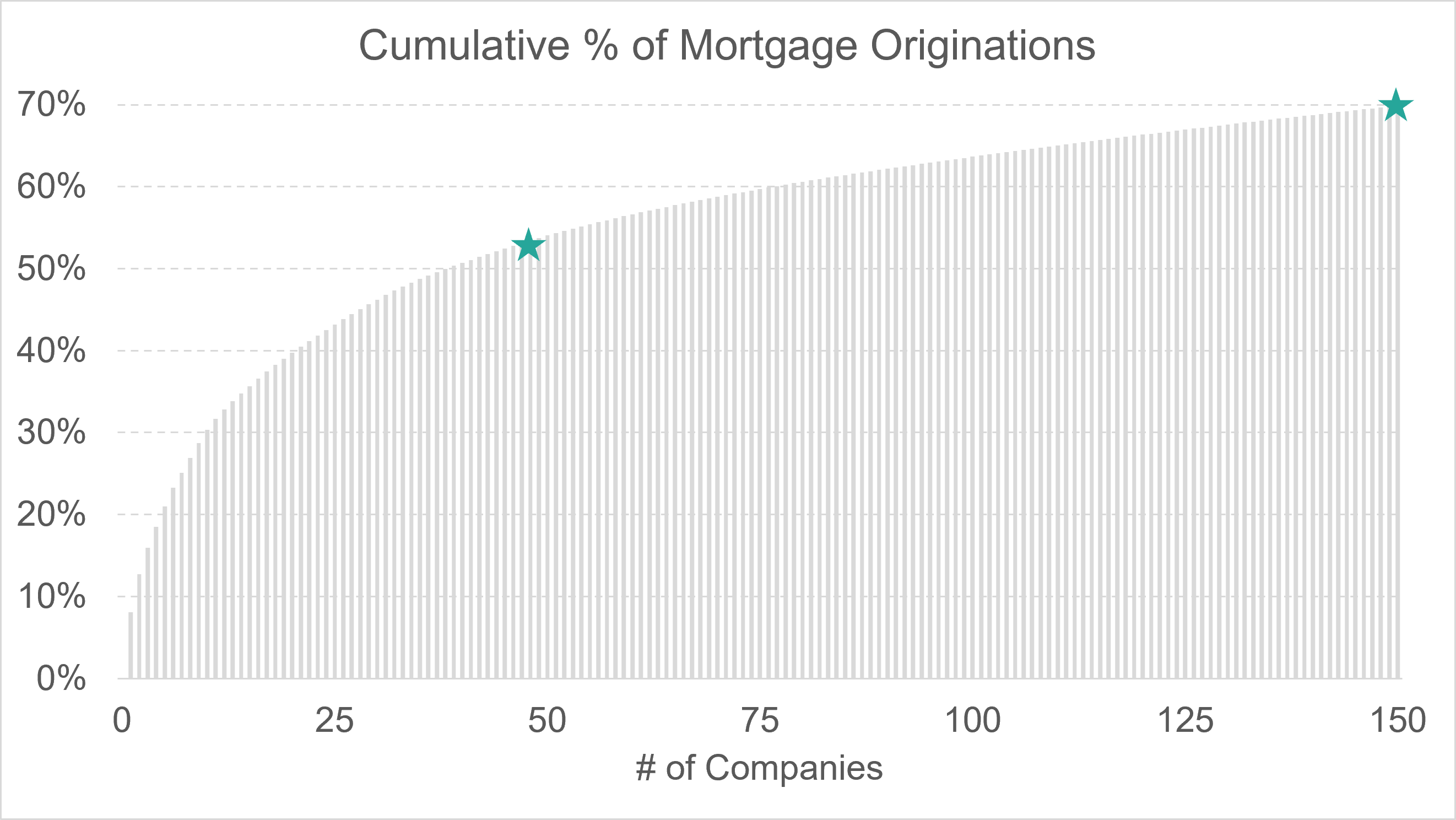

Initial interest Rate APR 2. Also bear in mind that there are mortgage lenders who are happy to offer deals based on 5x salary and even 6x salary under the right circumstances. To get some sense of the enormity of the national mortgage industry consider these statistics for 2021.

Among their many customized loan solutions is their Bank Statement product for self. Mortgage Amount Capital 212500. One or more major banks may be included depending on your search criteria.

Our Home Lending Specialists can help explain when Lenders Mortgage Insurance may apply to your home loan how much it will cost and. Were so confident in our service we. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher.

While your personal savings goals or spending habits can impact your. Factors that impact affordability. Your mortgage broker can get you a better interest rate when refinancing.

You repay the money based on the agreement you sign. Mortgage lenders prefer borrowers who have a stable predictable income to those who dont. If you have built up a lot of equity in your primary residence maximizing your retirement portfolio may be difficult with the payout limits of government-insured reverse.

When it comes to calculating affordability your income debts and down payment are primary factors. How To Buy A Home in Canada. It indicates how much of your monthly income goes.

Lock-in Redmonds Low 30-Year Mortgage Rates Today. Deposit 5 37500. Lenders mortgage insurance LMI can be expensive.

Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. More often lenders use credit scores along with other information such as employment history and proof of income to decide how much they are willing to lend you and at what interest rate. A bank that was willing to lend them 700000 before is now only able to loan them approximately 600000.

One point equals one percent of the loan amount. This is the amount you borrowed from the lender. The above list of lenders and lenders mortgage insurers arent ordered this way in our calculators results.

Maybe we should start with what they dont want. By default 30-yr fixed-rate loans are displayed in the table below. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

Some lenders are much more strict than others when it comes to affordability and debt so its important for you to find a lender whos more lenient. More often than not they lend you all of the money. But if you default that is if you dont pay off the loan orin some situations if you dont make your payments on time the lender has.

Your debt-to-income ratio DTI is also very important to mortgage lenders. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. Mortgage rates valid as of 31 Aug 2022 0919 am.

A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1 TB of cloud storage. A mortgage point also known as discount point is an amount paid to lenders to lower the rate of a home purchase or refinance. Landlords and utility companies also may use credit scores to help decide whether to charge you a security depositand how large it should be.

This is what the lender charges you to lend you the money. How much money could you save. The steps to buying someone out.

Filters enable you to change the loan amount duration or loan type. Its important for you to work out what your loan will cost you in terms of monthly repayments over the term. The AAG Advantage Jumbo Reverse Mortgage.

Online mortgage sites such as Rocket Mortgage New American Funding and Quicken Loans may directly originate loans but others eg eMortgage match loan requests to a network of lenders. 3 Preapproval is based on non-verified information and is not a commitment to lend by Truist Mortgage.

Usda Loan Pros And Cons Usda Loan Understanding Mortgages Mortgage

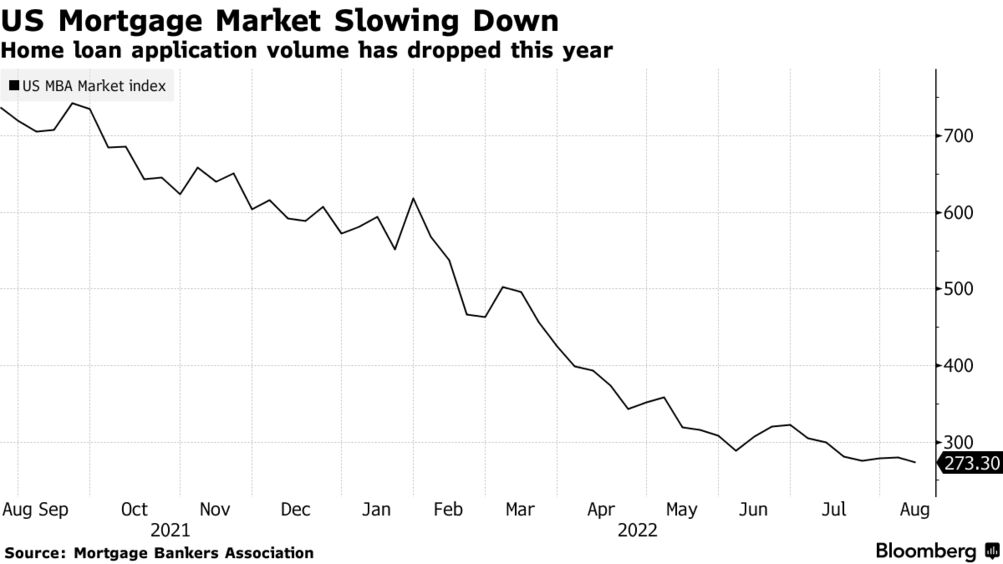

Us Mortgage Lenders Are Starting To Go Broke As Loan Volumes Plunge Bloomberg

Top 10 Mortgage Lenders Of 2021 Bankrate

The Best Mortgage Lenders Of September 2022

How To Choose A Mortgage Lender Money

9 Best Online Mortgage Lenders Of September 2022 Nerdwallet

What Is A Loan Estimate How To Read And What To Look For

How To Choose A Mortgage Lender Forbes Advisor

Best Online Mortgage Lenders Of 2020 Money S Top Picks

9 Best Online Mortgage Lenders Of September 2022 Nerdwallet

Since 1934 The Federal Housing Administration Has Been Insuring Fha Home Loans In The U S With Competitive Fha Loans First Time Home Buyers Buying First Home

:max_bytes(150000):strip_icc()/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Loan Officer Vs Mortgage Broker What S The Difference

The Top 150 Mortgage Lenders In 2020 Bundle

How Much Will A 400 000 Mortgage Cost Fox Business

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Loan Officer Vs Mortgage Broker What S The Difference

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice